The US Federal Reserve needs to raise interest rates again to combat high inflation, according to Fed governor Michelle Bowman. The central bank last week ended a year-long campaign to tighten monetary policy after raising interest rates 10 times, leaving its benchmark lending rate at 5-5.25%. Bowman, a voting member of the Fed's rate-setting committee, said its current tight monetary policy had some effect but inflation remained "far too high". She expects a "sufficiently restrictive" policy would require higher interest rates. A large majority of Federal Open Market Committee members believe two more hikes are needed this year.

Dow falls 51.05 points, S&P 500 opens lower by 10.29 points and Nasdaq Composite drops 58.79 points at the opening bell

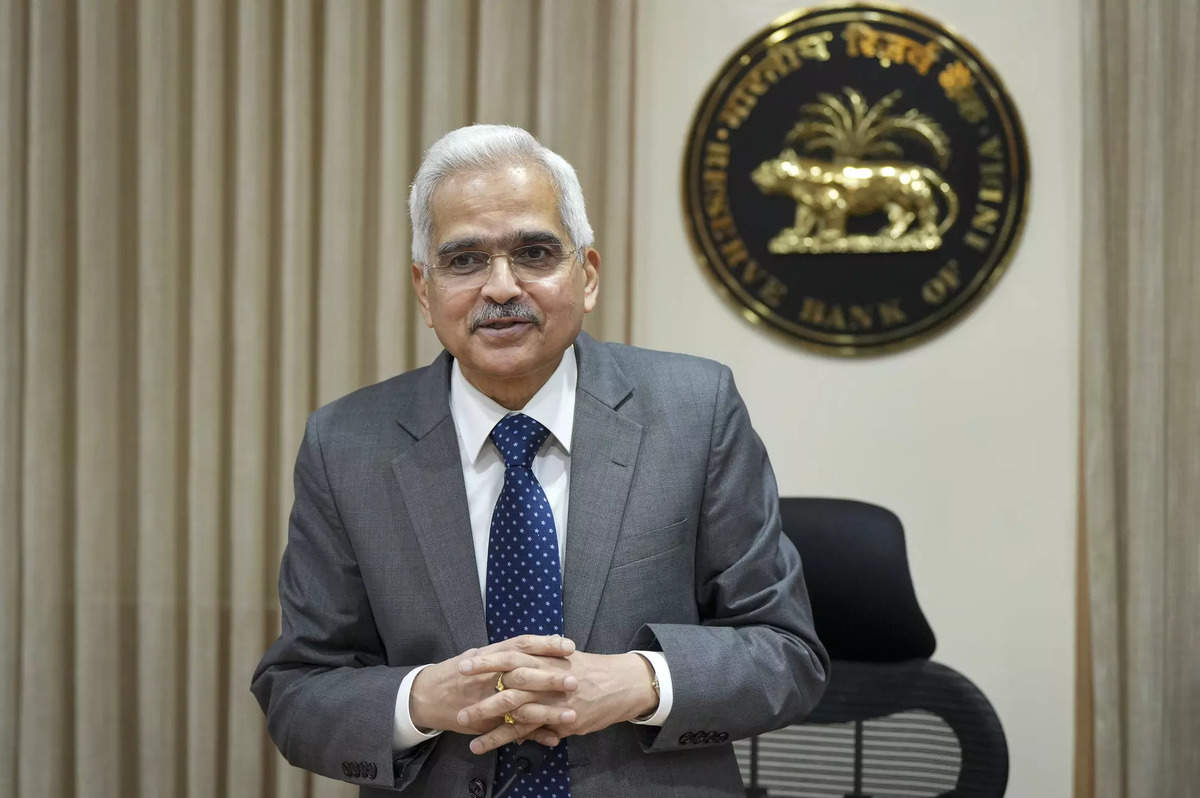

Reserve Bank of India's Governor, Shaktikanta Das, has stated that their job is only halfway done in regards to bringing inflation within the target band. During the MPC meeting, the Governor kept the short-term lending rate unchanged due to India's strengthening macroeconomic fundamentals, improving growth prospects, eased inflation, and improved external sector outlook. Despite this progress, Das believes that the fight against inflation is not over and the RBI must undertake a forward-looking assessment of evolving inflation-growth outlook and stand ready to act if the situation requires.

The Reserve Bank of India's (RBI) monetary policy committee members have differing opinions on future rate hikes, as per the latest meeting minutes. Some external members have argued that further tightening could hamper the economic recovery, while all three internal members of the RBI have remained focused on risks to inflation. While annual retail inflation is within the RBI's inflation band of 2%-6% for the third straight month, the RBI governor said the fight against inflation is not over, and the committee should undertake a future assessment of the evolving inflation-growth outlook and be ready to act as needed.

Regulator has barred its promoters, and CEO from the securities market on alleged breach of trade practice regulations. The order follows an examination of the company's financial statements, which indicated alleged misrepresentation of numbers and/or siphoning of funds.

Several companies in S&P BSE Smallcap stocks have approached their 52-week high levels, including Arvind, Kirloskar Industries, Waaree Renewable Technologies, AstraZeneca Pharma, Safari Industries, and KEI Industries, showcasing their strong momentum and growth potential. Arvind, a textile manufacturer, and AstraZeneca Pharma, a pharmaceutical company, both near their 52-week high marks, demonstrate stability and ability to deliver innovative solutions in their respective industries. Safari Industries, a luggage and travel accessories brand, and KEI Industries, a player in electrical cables and wires industry, also exhibit strong momentum and growth potential.

Several prominent companies listed in the BSE200 index, including Tube Investments of India, Supreme Industries, Bank of Baroda, and Bharat Electronics (BEL), have hit new 52-week high levels, showcasing their strong performance and growth potential. These companies represent diverse sectors and highlight their technological expertise, market leadership, and solid fundamentals. These milestones reflect the resilience and growing investor confidence in the banking sector, defense industry, and plastic and packaging industry.